Other Fees - Are there any other costs associate with the purchase of your car?įirst Payment Date - You can put in any date as the first payment date, it can be a date from the past, present or future.Īmortization Schedule - Show the amortization schedule by year or month.Įxtra Payments - Do you want to make extra payments on the car loan? There are four types of extra payments our car loan calculator support. Sales Tax - How much sales tax are you paying for the car. Trade In Value - If you have an old car that you can trade in, this is the field where you put in the trade in price of your old car.

Much ealier you can payoff your car loan. However, you can use the bi-weekly payment option to see how much interest you can save and how Payment Frequency - Monthly payment is the default option for car loans. Usually, interest rates are lower for those who have good credit. Interst Rate - The interest rate that you will be paying for the loan. 3 year and 5 year terms are common for auto loans. Loan Terms - The loan terms in years or months. Loan Amount - How much loan are you applying for to finance the car. Vehicle Price - The price of the car that you want to buy.ĭown Payment - How much are you putting down as initial payment for the purchase of the car.

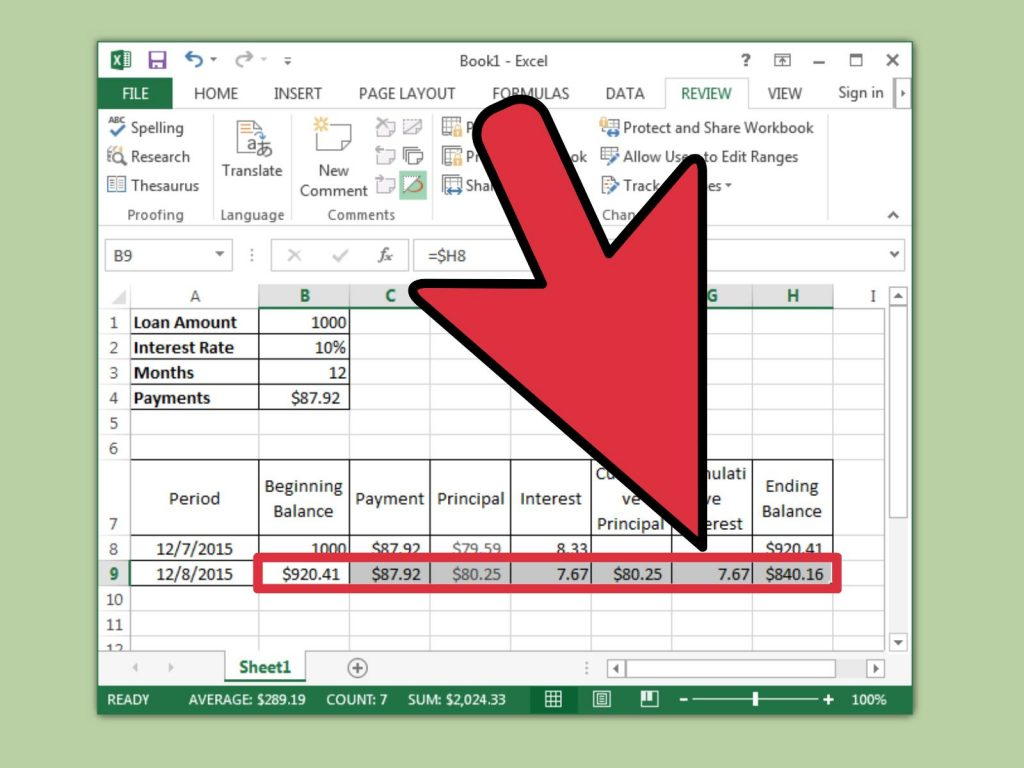

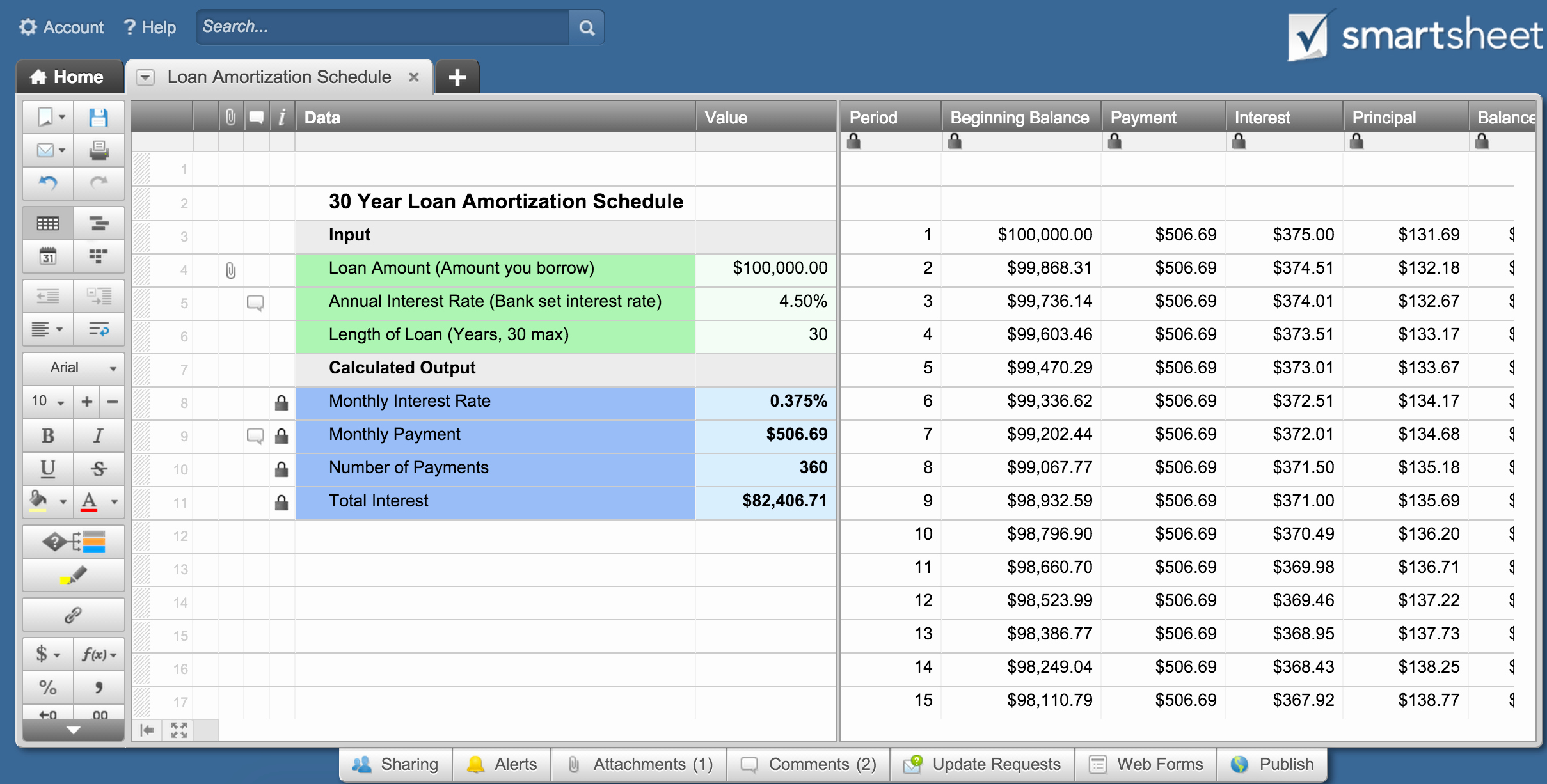

Press F9 repeatedly to watch how values change.Following are the terms for the car loan calculator which explains how you to use calculator. The Random Rate Change option can be fun to play with. Rather, it is designed to help you simulate what might happen if rates increase or fall. Variable Rate Simulation: This feature of the calculator is not meant to try to predict future rates. If you do that, you should probably highlight those cells so that you can identify that they no longer contain formulas. Tracking Payments: You can manually enter the Payment Date, Interest Rate, and Payment within the table if you want to track your actual payments, by overwriting the formulas. Read the Cell Comments: Most of what you may need to know about this HELOC calculator can be found by reading the comments identified by the little red triangles in many of the cells. Please do report an error if you suspect there may be one, but don't expect the calculations to match exactly. Due to the complexity of the spreadsheet, it wouldn't surprise me if the spreadsheet contains errors. There are many assumptions and simplifications built into the home equity line of credit calculator, so don't expect the amounts to match exactly with your bank.

0 kommentar(er)

0 kommentar(er)